How I Stayed Cool This Summer —A Financial Conversation Between Immigrants

In this first installment, Gulnara Mukhambet Kyzy, founder of EGMA Pro and a fromer CFO, shares five lessons—rooted in melted frappuccinos, Cartier rings and quiet generosity—that helped her stay financially cool through a hectic summer.

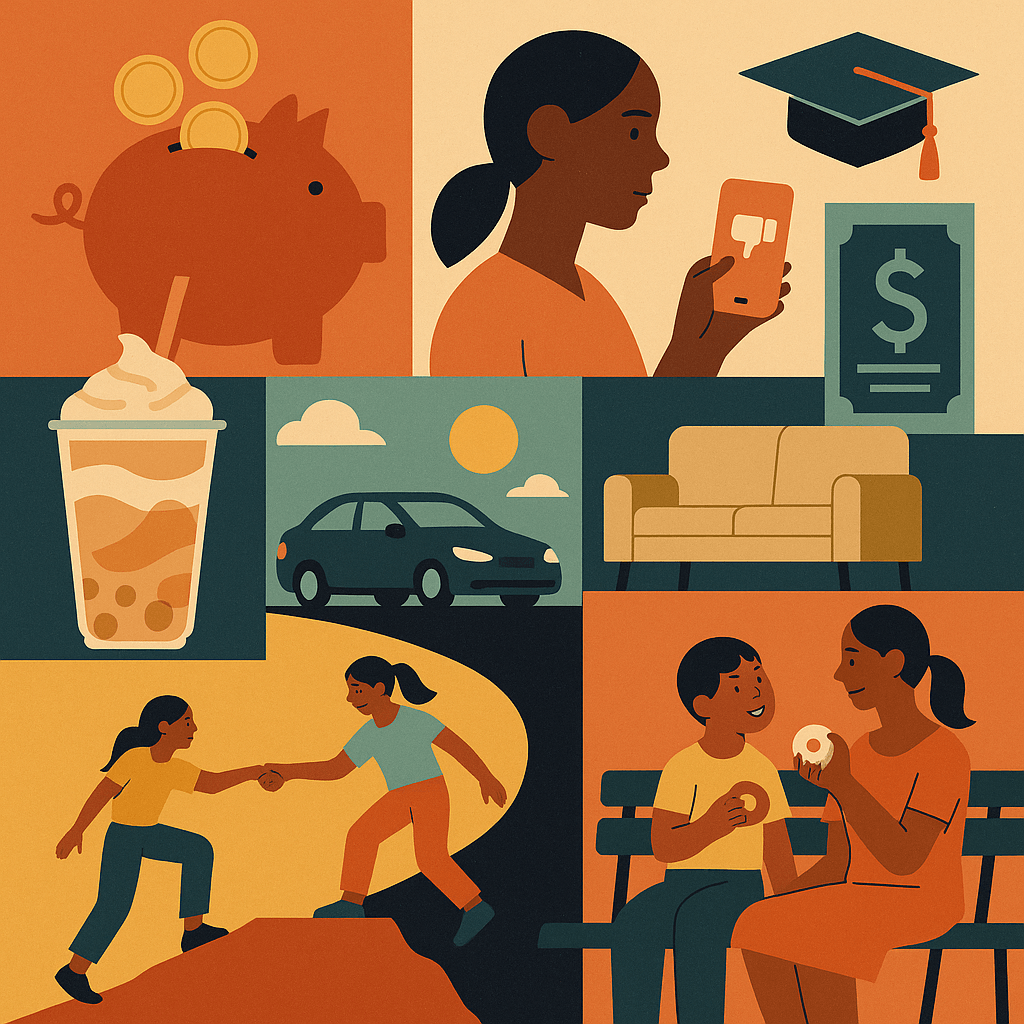

This illustration was created with the assistance of AI technology (DALL·E by OpenAI), guided by editorial inputs.

Gulnara Mukhambet Kyzy is a Kyrgyz American financial advisor and mother of two based in Fairfax, Virginia. As founder of EGMA Pro and a former CFO of a multinational firm, she brings both professional expertise and lived experience to this new Edgu Bilig column, which offers practical financial insight grounded in the realities of immigrant life. In this first installment, she shares five lessons—rooted in melted frappuccinos, Cartier rings, and quiet generosity—that helped her stay financially cool through a hectic summer.

Gulnara Mukhambet Kyzy, founder of EGMA Pro, a bookkeeping, tax service company. Image courtesy of author

It was a hot summer morning in Fairfax, Virginia. The temperature by 8 am had already crept above 85°F—sticky and just uncomfortable enough to make an iced coffee feel like a necessity. The morning had started with Kurman ait (eid) celebrations, followed by a business client call. Already behind schedule, I was navigating a 25-minute drive across Fairfax County—first to my 3-year-old son’s preschool graduation, then lunch with my 5-year-old daughter at her school, and finally her taekwondo tournament.

Dressed in formal clothes, I pulled into a McDonald’s drive thru. Their app flashed a deal: any size coffee for $0.99. At that price, of course I picked the biggest Frappuccino—it felt like a smart win. But in the heat, it melted fast, so I only drank half. The rest went straight to the trash.

As I drove away, I laughed to myself. How often do we “save” money, only to waste it moments later? That melted coffee became a metaphor. For how we let emotions, stress or habits drive our spending. That episode still reminds me today just how far I’ve come—and how many lessons I’ve had to learn the hard way.

Pay Yourself First: “One Day” Won’t Come Unless You Start Today

I came to the United States in August 2014 and settled in Fairfax, Virginia—where I still live today. I enrolled in an MBA program at Virginia International University and juggled multiple jobs just to scrape by: working as a cashier and a hostess and even driving for Uber.

Even renting an apartment with friends felt like a real stretch on my wallet. Needless to say, being able to save money felt impossible. Like many from post-Soviet backgrounds, I grew up with the mindset to live for today. As for the future, well, we’d figure it out later.

But “later” comes fast. I watched friends earn more and more, yet I still felt like it was never enough. That’s when I started setting aside 10% of every paycheck—no matter how small that came out to be. First, for education. Then for long-term investments. I had to get over the mindset of getting rich quickly and shift toward the idea about making sure my hard work translated into lasting security. In essence, through habit and discipline, I learned to pay myself first. After all, no one else will.

Don’t Let Stuff Own You: Freedom Is Better Than Applause

I bought a Cartier ring once. It was stunning—and the compliments poured in. “Wow, is that real?” “You deserve it!” And yes, the “ahhs” and “ohhs” felt good—for a day or two.

But within a week, the thrill wore off. I wore it while doing chores, and it just blended into daily life. It started to feel like something I was “supposed” to want, based on what others valued. The gleam of it faded quickly, however.

So, I started buying only what brought peace and meaning—not praise. Now, I find that in road trips with my family, long-term investments, a much-needed new couch and practical, quality clothes from Costco. Choosing simplicity has brought me more joy than anything glimmering ever has.

Unfollow the Fantasy: Real Life Deserves More Attention

About a year ago, after leaving my full-time job, I noticed something unsettling. On Instagram, I was following nearly 500 accounts—mostly lifestyle influencers and career-focused content creators. Their curated posts showed perfect morning routines, glowing skin, luxury workspaces and happy family photos. But my brain started stitching those moments together into one false reality.

It made me feel behind, even when I was doing well.

So, I began unfollowing people. I kept those friends who were living honest, balanced lives. The ones who shared both their wins and their hard days. They reminded me that being a great mom and building a meaningful career often requires trade-offs—and that was okay.

Financial clarity starts with mental clarity. You can’t manage your money well if fantasies crowd your vision.

Treat Others With Intention: Memories Matter More Than Menus

One Sunday, my husband and I took our two kids out for donuts. We stopped at the neighborhood Dunkin’ Donuts and walked over to the nearby park. We sat on a bench, sticky fingers and all, giggling over frosting-covered donuts. It was spontaneous and simple. No distractions. Just the four of us, fully present.

It cost $10. But the joy? Priceless.

Contrast that with fancy restaurants where the kids stare at screens and parents stress over the bill. I’ve learned that treating oneself isn’t about impressing anyone. It’s about choosing experiences that nourish joy, not anxiety. The best memories don’t always come with a menu—they come from the people we share them with.

Give from the Heart: One Gift Can Change a Life

I still remember the day—when I was 12—my parents sat me down in our rented apartment in Belovodsk, a village in the north Kyrgyzstan. My father was trying to start a farming business, and my mother stayed home with us. Money always felt tight. They explained, with visible hesitation, that we might not be able to afford the school I had dreamed of: a Turkish high school in Bishkek.

The tuition was $700 per year for five years—a fortune for us at the time.

That’s when my dad called my uncle in Russia, who had built a successful career there. Without a second thought, he offered to help cover the cost, not asking for anything in return. He simply said, “This will change her life.”

And it did. That school shaped me academically, socially and professionally. I later earned a scholarship abroad—and I still remember crying in the hallway of the student center at my American university the day I got that news. I called my uncle to thank him, words catching in my throat.

Years later, I helped my younger sister transfer into a similar Turkish-Central Asian school network. At the time, she was struggling and lacked motivation. But that new environment changed her. She started dreaming again. She made close friends. She began believing in herself. That, to me, is the most fulfilling kind of return.

Giving doesn’t have to mean covering tuition. It can be sending a small gift home, helping with a family emergency or supporting someone’s passion. Giving reminds us that wealth isn’t what we keep—it’s what we pass on.

Final Thought

When I first arrived in the US, I kept waiting to find one expert, one perfect formula, that would make my finances fall into place. But the truth is, no one has it all figured out.

What works are small steps. Real conversations. Consistent choices.

So, whether we’re driving in the heat or preparing for fall, the key lies in how we spend, give and grow.

As we say in Kyrgyz: Tyiyn chogulsa, tenge bolot (“When coins are gathered, they become a tenge). Small actions, taken consistently, build real wealth.